This structure is consistent across all regulations

BSA / AML

OFAC/ Sanctions

Fraud Testing

FCRA Testing

FCPA / ANTI-BRIBERY TESTING

MODEL RISK (SR 11-7)

THIRD-PARTY RISK (FINCRIME VENDORS)

GOVERNANCE & OVERSIGHT

ABC

KYC / CDD

Transaction Monitoring

QA & Validation

— Former CustomerFinancial Crimes & Regulatory Testing, Built the Way Regulators Think

I design financial crimes testing programs by starting where regulators start: the regulation, the risk it creates, and how controls fail — not just whether a box was checked.

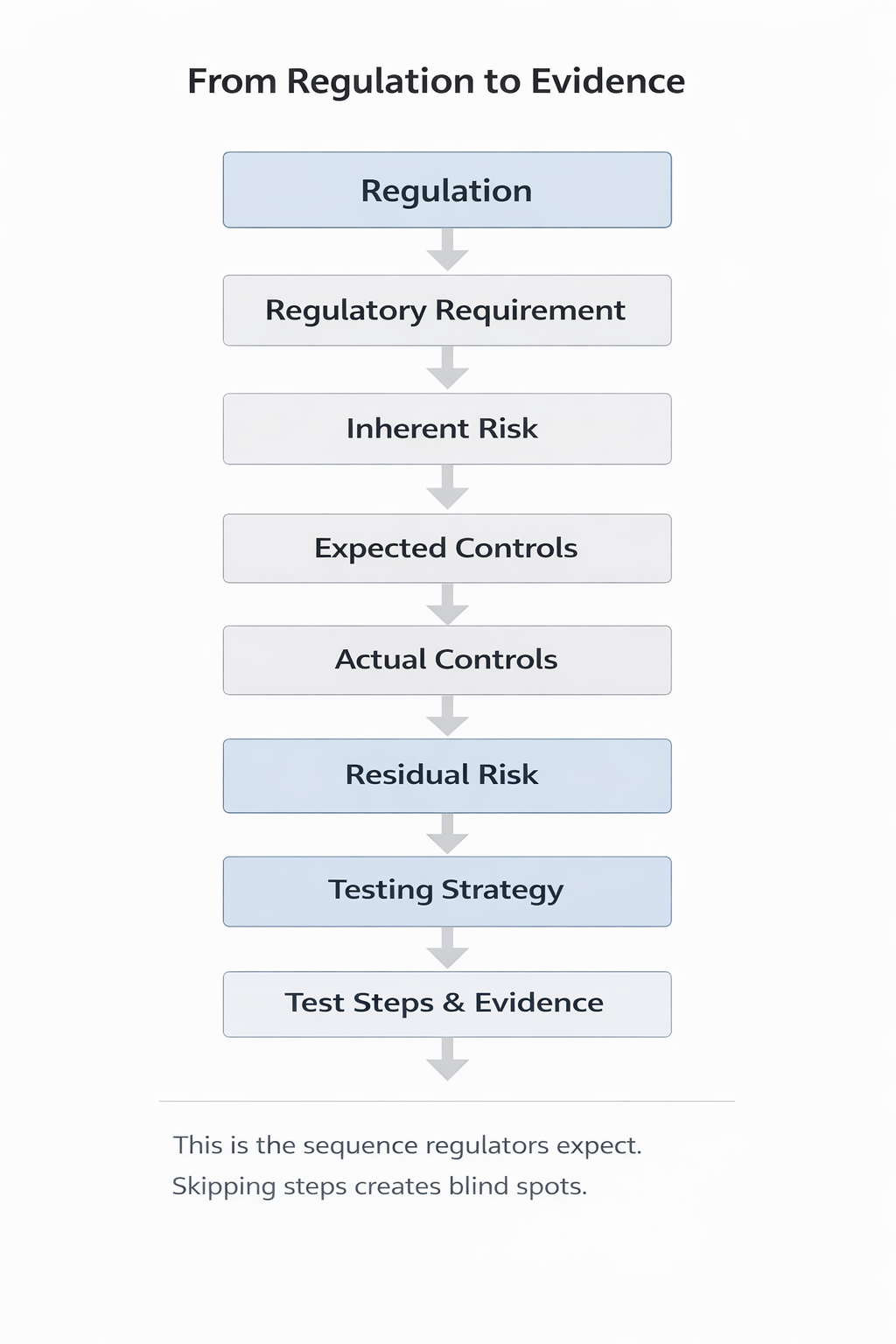

My framework translates regulatory requirements into inherent and residual risk, maps expected and actual controls, defines how each control should be tested, and documents executable test steps and failure modes across AML, sanctions, fraud, and consumer protection.

The result is a single, defensible testing universe that supports regulator exams, audit committees, and executive decision-making.

Designed for global banks, complex regulatory environments, and high-risk financial activity.

How I Approach Financial Crimes Testing

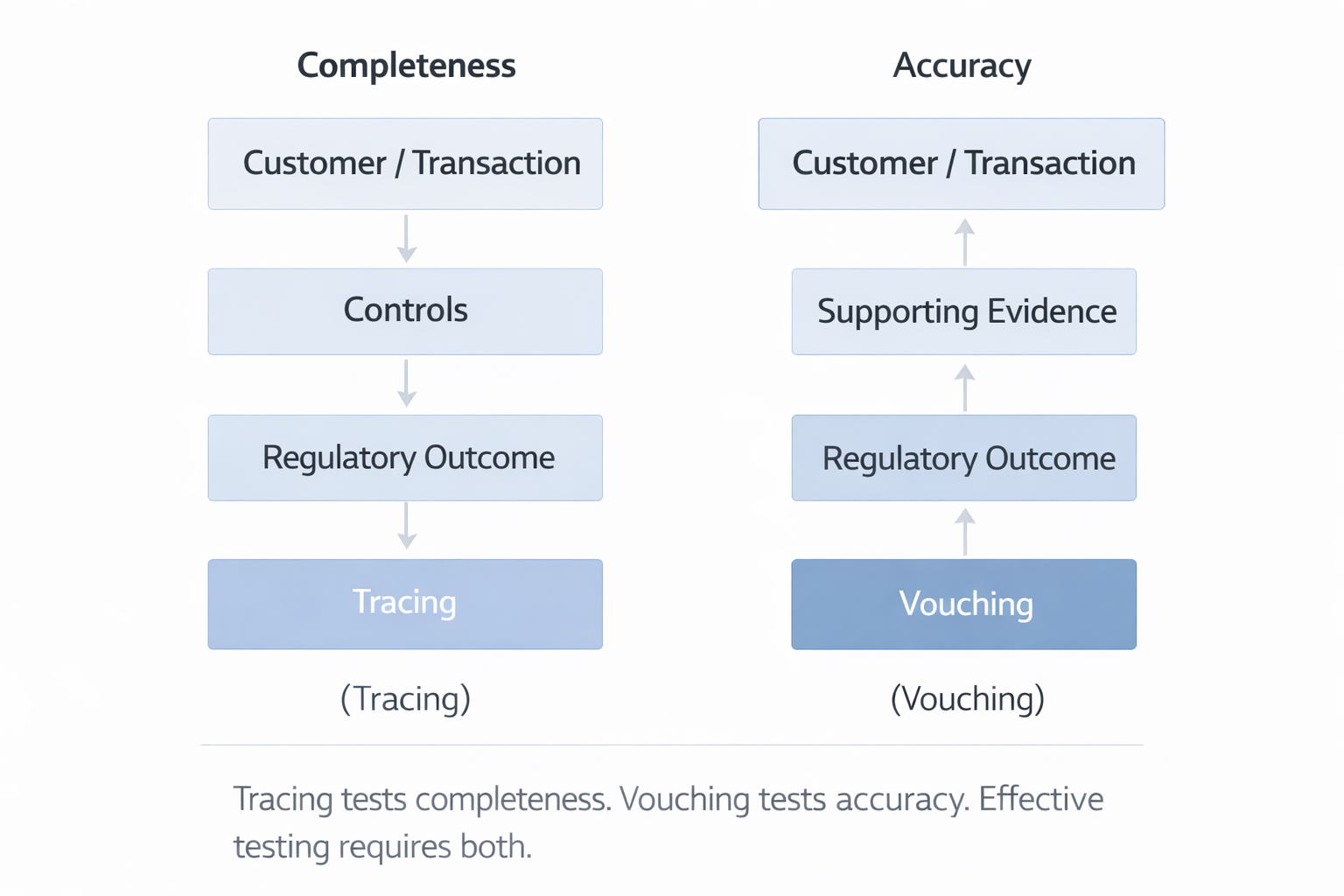

Financial crimes testing is an assurance discipline. Like accounting, it is designed to test both completeness and accuracy — applied to regulatory obligations instead of financial statements.

Why This Sequence Matters

This sequence is intentional. Regulators do not start with testing results — they start with the rule, the risk it creates, and whether controls are designed and operating effectively to mitigate that risk.

Testing that skips directly to samples or outcomes without anchoring back to regulation and risk produces false comfort and missed exposure.

Tracing vs. Vouching (Completeness vs. Accuracy)

In financial crimes testing, completeness is tested by tracing activity forward — from customer or transaction, through controls, to regulatory outcomes.

Accuracy is tested by vouching backward — from reported outcomes to supporting evidence and underlying activity.

Why this matters

Regulators routinely find deficiencies where testing focuses on outcomes without validating completeness, or where samples are reviewed without confirming population coverage. Tracing and vouching together provide defensible assurance that regulatory obligations are both fully captured and accurately executed.

BSA / AML Testing Playbook (Example)

Below is an example of how this framework is applied to BSA / AML obligations in practice.

Regulatory Anchor

Primary regulation: Bank Secrecy Act (31 CFR Chapter X)

Regulators: FinCEN, Federal Reserve, OCC, FDIC

Regulatory objective: Detect, prevent, and report suspicious activity and illicit financial behavior

Key Risk Areas

Failure to identify suspicious activity

Incomplete transaction monitoring coverage

Ineffective customer risk rating

Untimely or inaccurate SAR filings

Weak escalation and case management controls

Inherent Risk Assessment

Inherent risk is driven by:

Customer types and geographies

Products and services offered

Transaction volume and velocity

Use of automated monitoring models

Reliance on third-party data sources

High inherent risk requires broader coverage and deeper testing.

Expected Controls

Customer risk rating and segmentation

Automated transaction monitoring scenarios

Alert generation and queue management

Analyst review and escalation procedures

SAR decisioning, preparation, and filing

Management oversight and quality assurance

Actual Controls Evaluated

Automated monitoring rules and thresholds

Case management workflows

Manual analyst review and disposition

Supervisory review and approval

SAR filing and FinCEN submission controls

Controls are classified as automated or manual to determine testing approach.

Residual Risk Determination

Residual risk reflects:

Control design effectiveness

Control operating effectiveness

Degree of manual judgment

Volume of exceptions or overrides

Residual risk directly informs testing frequency and depth.

Testing Strategy

Testing is designed to address both completeness and accuracy:

Tracing (Completeness):

Start with customer or transaction populations

Confirm coverage by monitoring scenarios

Verify alerts are generated and reviewed

Confirm escalation to SAR decisioning where appropriate

Vouching (Accuracy):

Start with SARs and closed cases

Validate supporting transaction data

Confirm rationale, documentation, and approvals

Trace back to underlying customer activity

Testing Methodology

Automated controls:

Eligible for 100% population testing using system data

Manual controls:

Risk-based sampling using judgmental or statistical methods

Judgmental decisions:

Scenario-driven review and rationale assessment

Sample Test Steps

Obtain population of in-scope customers and transactions

Confirm inclusion in monitoring scenarios

Recalculate alert logic and thresholds where applicable

Review alert disposition and escalation timeliness

Validate SAR decision rationale and documentation

Confirm SAR filing accuracy and timeliness

Assess management review and QA results

Evidence Retained

Transaction data extracts

Alert and case logs

Analyst notes and escalation records

SAR filings and confirmations

Management review and QA reports

Failure Modes Addressed

Transactions not captured by monitoring

Alerts improperly closed

Escalations delayed or unsupported

SARs not filed when required

Insufficient documentation to support decisions

Outcome

A defensible testing conclusion that demonstrates:

Full population coverage

Accurate regulatory reporting

Traceability from regulation to evidence

Readiness for regulatory examination