Here’s a detailed comparison of NICE Actimize vs Verafin, two leading financial-crime / AML / fraud-detection platforms, to help you assess which might be a better fit for your institution.

NICE Actimize

Actimize is part of NICE Ltd. and is a large, mature solution in the financial-crime / risk & compliance space.

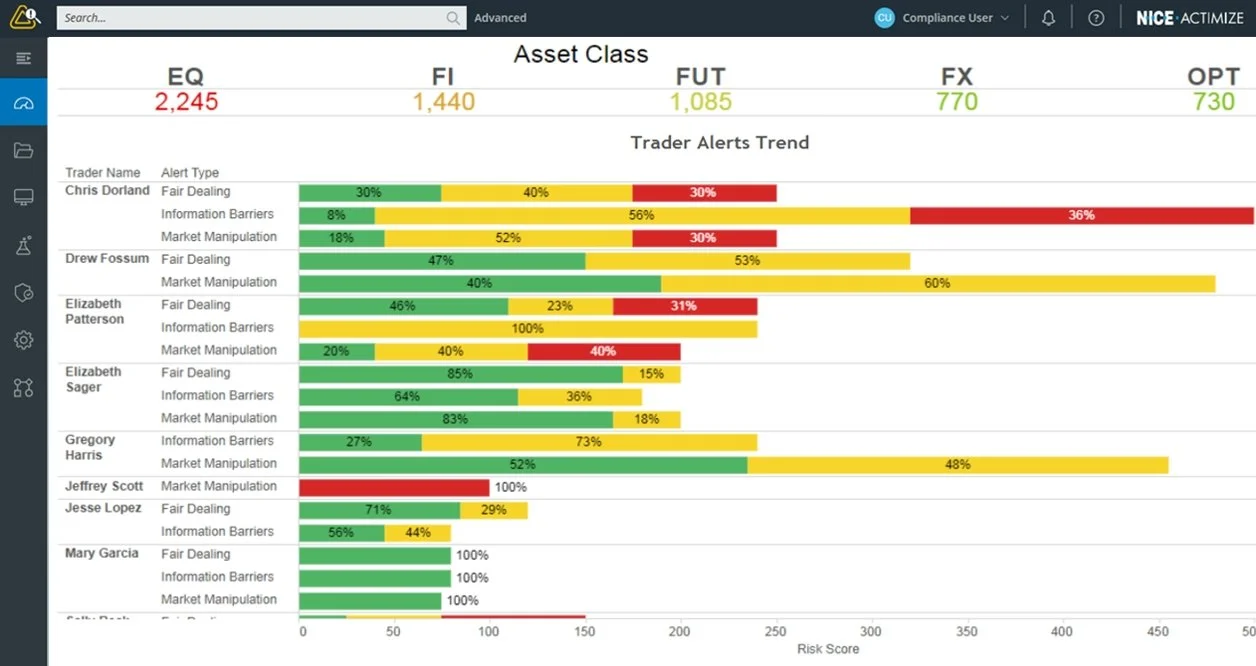

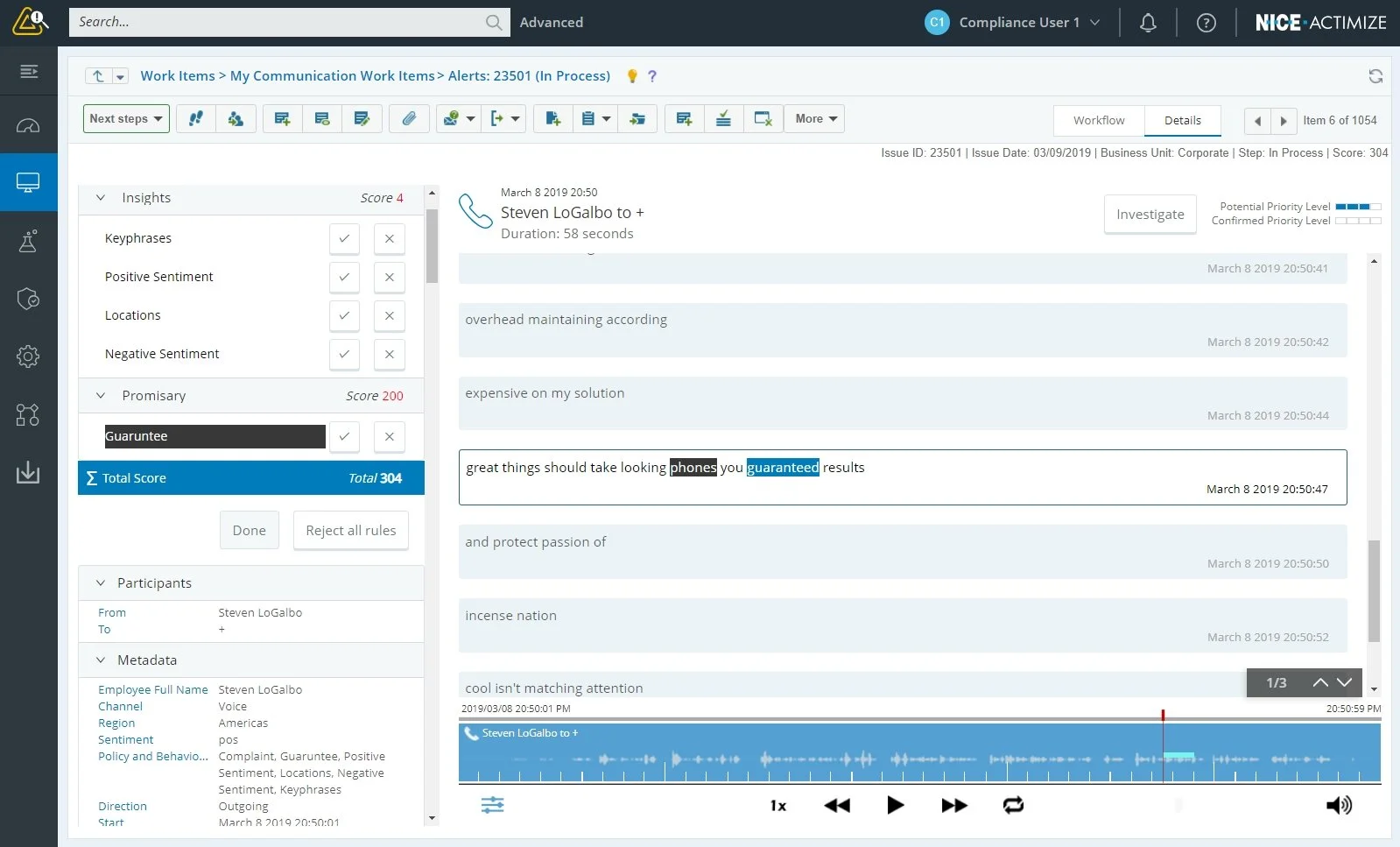

It offers very broad coverage: AML (KYC, sanctions screening, transaction monitoring), fraud (cards, payments, checks, online), trade surveillance, case management, etc.

Strong on enterprise / large institution use-cases: multi-jurisdiction, high volume, complex risk profiles.

They highlight “entity-centric” AML, AI/ML enhancements (reducing false positives, automation) as key features.

Deployment flexibility: on-prem + cloud/hybrid options; high customisation.

Because of its breadth and depth, implementation can be more complex and resource-intensive.

Verafin

Verafin (now part of Nasdaq, Inc.) is a cloud-based anti-financial crime platform focused on fraud, AML, payments, check & wire fraud, and “consortium” analytics (sharing data across institutions) especially in North America.

Their value proposition includes ease of use, faster deployment, and leveraging data across many institutions to detect typologies and patterns.

Especially strong for mid-sized banks/credit unions and for fraud/AML use-cases where consortium data adds value.

Some user feedback points to strength in GUI/analytics, but potential limitations in customization or very large complex enterprise settings.

What this means for your institution / considerations

Given your institution’s risk profile, regulatory jurisdiction, size, channels and budget, here are things to ask and watch:

If you lean toward Actimize

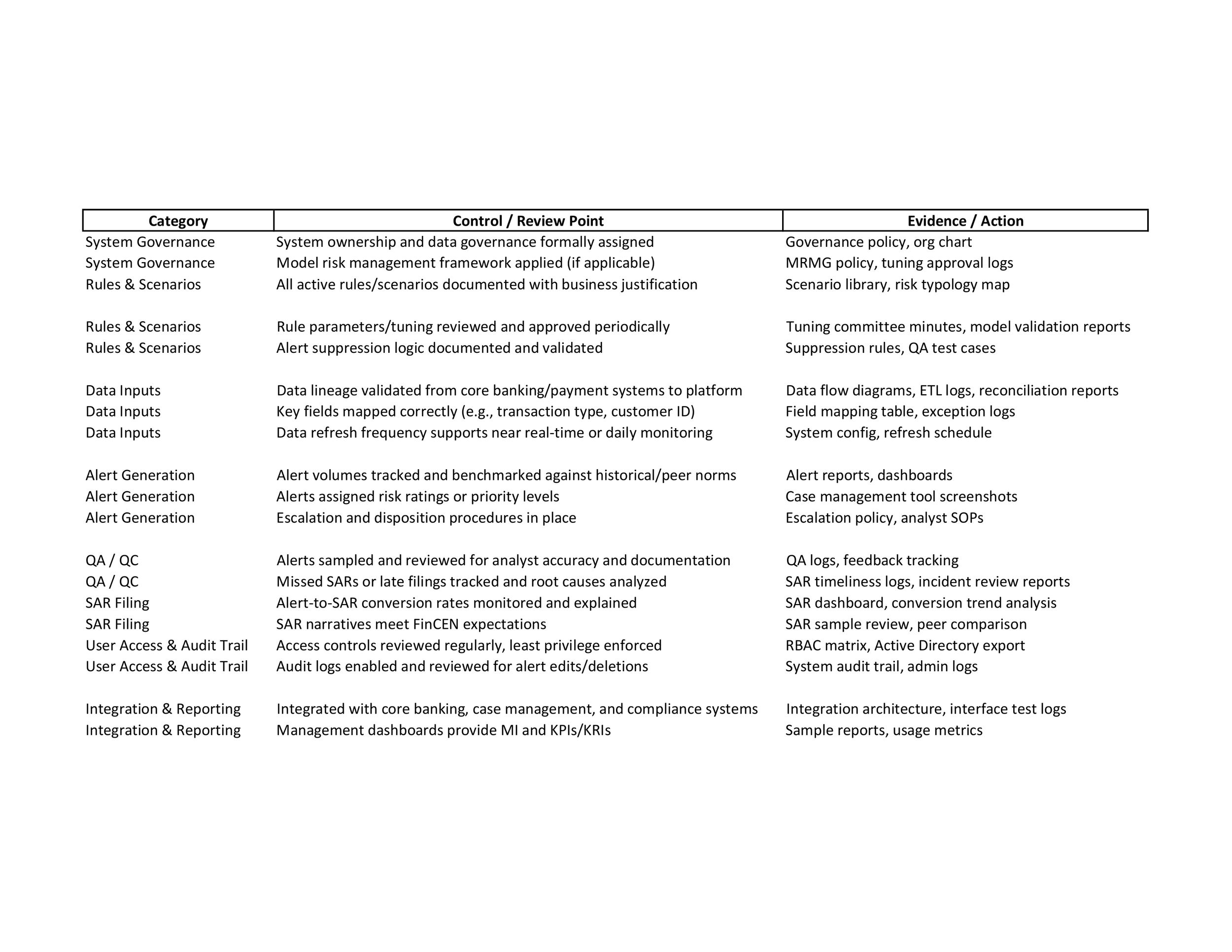

Do you have significant resources (budget, internal modelling, IT, compliance) to implement and maintain a large-scale platform?

Are you operating globally (multiple countries, multiple payment rails, multiple regulatory regimes) such that a very broad platform makes sense?

Do you need deep customisation, complex rule-writing, entity-centric analysis, high sophistication in AML/fraud/money-laundering typologies?

Are you comfortable with a longer implementation timeline and higher total cost (but higher capability)?

Can you maintain the ongoing cost of ownership — tuning models, updating rules, internal governance?

If you lean toward Verafin

Is your institution north‐American centric (US/Canada) and of small to medium size (regional bank, credit union) with moderate complexity?

Do you need faster time to value and lower total cost of ownership?

Does the consortium model (shared data across institutions) appeal and add value for you?

Accept that the platform may be less deeply customisable than a heavyweight enterprise system.

Are you okay with a somewhat “packaged” solution rather than building from the ground up?

My recommendation based on your context

Since I know you work in the banking/regulatory/compliance space and you’ve handled complex litigation, here are my thoughts:

If your Bank has high volume, multi-jurisdiction, many payment rails, complex AML/fraud exposure, then Actimize is likely the stronger choice despite higher cost/complexity.

If the Bank is more domestic (US only), moderate size/regional, need strong fraud/AML coverage but want efficiency, then Verafin may be a better fit for cost/time.

Given your expertise, you will want to pay particular attention to: regulatory audit trails, flexibility in case management, ability to tune/override rules, integration with your existing data flows, cost of false positives, and vendor support/training.